Corporate Plan Consulting

Private Wealth Management

Corporate plan consulting

Institutional Portfolio Services

About Us

For decades, SFSI has been an independent fee-based consultant delivering unbiased advice. As experienced ERISA consultants, we maintain a neutral and autonomous position in the industry with regards to vendors, investments, research and how we are compensated. Our decision to remain a distinct entity instead of merging with a larger national firm allows us to deliver individualized and custom reports to our plan sponsor clients. We will not offer a cookie cutter output of reports, fund line ups or utilize single source research tools which results in impersonal and robotic advice platform. Uniqueness is what sets us apart, and what we appreciate in all our clients. We believe in the human touch and have assembled a highly experienced consultative team with extensive industry experience to support our proactive and highly detailed service model.

Our Purpose

We partner with our clients to ensure that their retirement plan is meeting their goals for attraction and retention of their desired workforce, that plan participants are on track to achieve their saving and investing goals, and that fiduciary obligations are being met and documented.

From cost control to compliance and counsel to communication

SFSI provides fiduciary oversight of the plan

- Development and orientation of investment committee

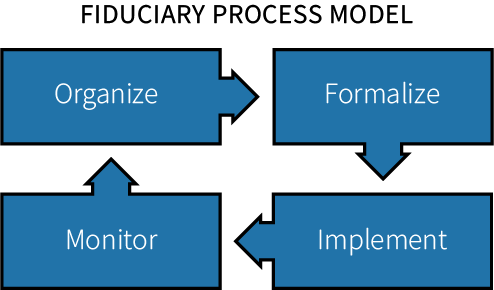

- Implementation and monitoring of best practices using Department of Labor guidelines and Center for Fiduciary Studies methodology

- Annual reviews include

- 404(c) regulations

- Plan operations

- QDIA suitability

- Self-assessment of fiduciary excellence

- Quarterly fiduciary investment review of plan investments

- Target maturity fund assessment, selection and monitoring

- Development, oversight, and reporting on managed portfolio strategies

- Full fee disclosure and benchmarking

- Additional plan benchmarking available

- Plan conversion management and employee communication

our best match

Our long-term partnerships are most successful when we engage with Plan Sponsors who are committed to enhancing their plan design and employee outcomes. Paternalistic companies who want a strong, consistent process in place to monitor and document their decisions and seek a high touch service model align well with our firm.

How We Deliver

Independent

Our experience has positioned us to work with any and all vendors, custodians, and trust platforms

Commitment to quality and client satisfaction

Custom and personalized, proactive service model designed to meet a variety of unique client needs

Consultative approach

High attention to detail accomplished through our team approach

Advocates and promoters of the retirement industry

- Participate and speak at industry conferences

- Current on legislative issues and policy platforms

- Promote financial literacy among plan participants and in the community

- Host educational seminars throughout the year

How To Engage us

- Project-based or ongoing retainer-based consulting services

- Flexible fee approach to meet your needs

Unbundled Independent Service Team

- Best in class independent retirement consultants

- Fiduciaries for plan that we consult—typically 3(21) and 3(38)

- Committed to participant retirement outcomes

- Flexible and nimble in our service model

- Held to a high standard of excellence by ourselves and to our clients that we serve

- Advocates for the plan and the participants by working with the vendor and service providers to disclose, deliver, and engage in a collaborative bilateral process

- Followers of fiduciary best practices which includes, documentation, oversight, transparency, accuracy, and communication

Understanding Your Fiduciary Obligations

- Operate in the best interest of plan participants

- Ensure that your plan is being administered in accordance with its provision

- Ensure that you are monitoring your service providers

- Ensure that compliance activities are taking place – such as testing, filing of Form 5500, required notices are prepared and delivered, etc.

- Understand and monitor all plan fees for reasonableness

- If participants can direct their own investments, provide an array of choices and ongoing access to information

- Monitor the investment lineup in accordance with your Investment Policy Statement

- Determine a QDIA that is appropriate for your workforce

- Document all decisions made

ExAMPLES OF fiduciary oversight Functions

- Formalization of investment / plan committee.

- Implementation and monitoring of best practices using Department of Labor guidelines and Center for Fiduciary Studies methodology.

- Consulting Services Include:

- Quarterly fiduciary investment review of plan investments

- Target maturity fund assessment, selection and monitoring

- Development, oversight, and reporting on managed portfolio strategies

- Full fee disclosure and benchmarking

- Additional plan benchmarking available

- Participant services including employee education, group meetings and one-on-one consultations

- Plan conversion management and employee communication

- RFI and RFP services

- Annual Reviews Include

- Adherence to 404(c) Guidelines

- Plan operations oversight

- QDIA suitability

- Self-assessment of fiduciary excellence

- Summary of previous year achievements

- Planning and goal setting for the upcoming year