Institutional Portfolio Services

Private Wealth Management

Corporate plan consulting

Institutional Portfolio Services

Portfolio Management

Our independent firm delivers a custom approach to working with client portfolios. We pay special attention to client goals, risk profile and expectations while maintaining reasonable portfolio costs.

Our Philosophy in how we Manage Portfolios :

- We believe in active management.

- We seek to reduce overall portfolio expenses by owning individual securities and we minimize or, in most cases, eliminate investment solutions with ongoing separate fees and expenses.

- We consider tax implications in our overall trading and portfolio management and seek tax efficiency for our clients.

- We utilize multiple research tools and information sources to discover our investment ideas and ultimately select the securities in our portfolios.

- We have developed a proprietary screening process that employs factor analysis to help us arrive at a targeted buy list universe.

- We combine a growth bias in equities with defensive, valuation sensitive oversight. We are Growth at a Reasonable Price (GARP).

- We also build income focused portfolios for those investors that seek income.

- We seek equity sector neutrality and rely on effective individual security selection.

- We build bond ladders for our portfolio’s fixed income allocation.

- Bond ladders are focused on investment grade securities and we seek discounted, or low-premium priced bonds.

- The fixed income allocation is designed with the purpose of reducing overall portfolio volatility and to provide reliable income for the client.

- Our goal is to provide relative outperformance vs the equivalent custom benchmark over a full market cycle, but we are guided by the principle of liability driven investing.

- We believe in a fee–based arrangement and discretionary management to ensure that we have the flexibility and control to make changes in a portfolio in adherence to predetermined goals, guidelines and risk parameters.

Considerations in How We Manage Portfolios:

- Investment policy statement directive

- Income replacement

- Tax impact

- Asset-liability matching

- Liability-driven investing

- Spending policy guidance

- Endowment preservation

- Risk assessment and time frame with expected portfolio longevity

- low-premium priced bonds.

- The fixed income allocation is designed with the purpose of reducing overall portfolio volatility and to provide reliable income for the client.

- Our goal is to provide relative outperformance vs the equivalent custom benchmark over a full market cycle and or reasonable income to meet ongoing cash flow needs.

- We believe in a fee – based arrangement and discretionary management to ensure that we can be nimble in making changes in a portfolio in adherence to predetermined goals, guidelines and risk parameters.

Clients We Serve:

- Individuals and Families

- Trusts

- Estates

- Foundations and Endowments

- Retirement Plans

- Corporate Invested “Cash” Accounts

How we help:

- Strategic risk-based portfolio management

- Asset-liability matching

- Liability-driven investing

- Hedging strategies

- Investment policy statement development

- Spending policy guidance

- Continuity during board transitions

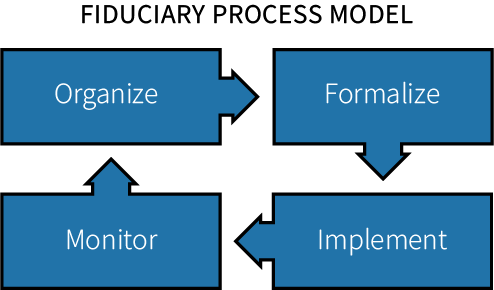

- Periodic, structured reviews to maintain governance and investment oversight

- Endowment preservation

- Defining the fiduciary role